A single figure disproportionately determines the tone and direction of political activity from Capitol Hill to Brussels, and that figure is gross domestic product (GDP). Perhaps less a number than an idea, many think of GDP as the economic value of a nation. Beyond that, however, it does not seem to attract much further thought. This is in error. The simple choice to include GDP in policy discussions is itself political, and it should be appreciated as such.

All discussions of GDP are also implicitly discussions of what constitutes the economic value of a nation. GDP captures the sum of consumption, investment, government expenditures and net exports, but ideas of economic value are nebulous and understandings of what it means are pluralistic. In fact, a variety of different figures could realistically claim to represent national economic value, making it strange that GDP retains its singular status in our political discourse as the defining symbol of economic health. Additionally, however, it turns the descriptive question — “what determines the economic value of a nation?” — into a normative one: What should be considered in determining the economic value of a nation? Merely adding up consumption, investment, government expenditures and net exports produces an incomplete picture.

The fundamental problem with GDP is that how an economy grows is just as important as how much it grows. In failing to include important information about how the economy is growing, GDP fails to provide a complete picture of the economic landscape. Critiques of GDP based on questions of how growth happens fall into two categories: those concerned with unrepresented economic factors and those concerned with unrepresented non-economic factors.

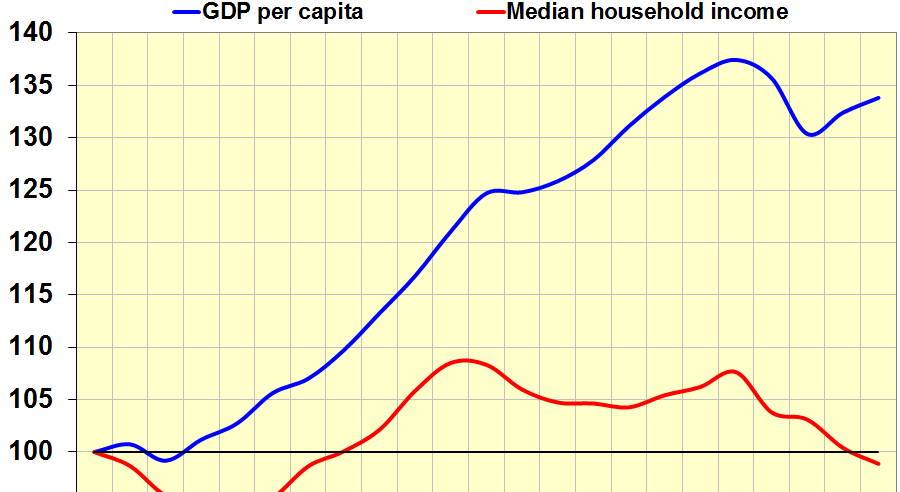

GDP fails to represent both inequality and financial sector risk. With respect to inequality, GDP creates the false impression that a three percent growth rate is necessarily better than a two percent growth rate, even if that three percent growth accrues only to the top five percent of wage earners, while the two percent growth might accrue more evenly across the economy. For this reason, even GDP growth per capita, which controls for population size, should be basically meaningless to 99 percent of Americans, given how unevenly it has been distributed across incomes throughout recent history. Regarding financial sector risk, it’s true that the economy would grow faster — at least in the short term — with a completely unregulated finance industry. But even setting aside the question of where those gains would accrue, they likely aren’t worth their price in increased volatility. Without current financial regulation, the business cycle would oscillate between substantial booms and catastrophic recessions with a viciousness that would meaningfully outweigh the marginal benefits to GDP of such deregulation.

These discrepancies hint at the broader problem: GDP is, by nature, an indicator with a particular bias for short-term gains, often at the expense of long-term sustainability. This bias extends to unrepresented non-economic factors as well, like the environmental costs of economic growth. While building more factories and burning more fossil fuels may generate significant economic activity in the short term, it may also render our world uninhabitable in the long term, which seems worth recognizing in policy discussions.

One might respond to these arguments by pointing out that while GDP probably shouldn’t be considered in isolation, it can be useful when examined alongside other indicators of prosperity. This would be true if popular understandings of GDP were grounded in what the indicator actually represents. But GDP isn’t like inflation — it’s far less concrete. While different methods of tracking inflation may have slight political implications, inflation itself is a very specific concept. Just about everyone familiar with the term defines it the same way: the rate at which the purchasing power of a dollar changes from year to year. GDP is different for two reasons. First, most people do not know what it actually measures. Second, it has a symbolic power in political discussions that is deeply disproportionate with what it realistically represents.

GDP sits on a pedestal in our political discourse as the unquestioned representation of the country’s economic status. Politicians treat GDP (or GDP growth) like a party piece; they wave it as a flag of economic success. In doing so, they often demonstrate a misunderstanding not only of how it should be considered in policymaking, but also of how it works at a fundamental level. This misunderstanding could mean that voters simply don’t realize that they have no reason to get excited about GDP growth, since they are statistically unlikely to reap the benefits of it. However, the focus on GDP could also mean our politicians recognize that appealing to the corporate actors that do benefit significantly from GDP growth is more important to their reelection prospects than appealing to the average voter.

As a result of its political importance, GDP plays an enormous role in policy discussions, both in the United States and abroad. Domestically, the Congressional Budget Office scores pending legislation according to the impact it will have on economic growth and the federal budget deficit. These estimates can substantially affect how such legislation is perceived by the public and therefore its odds of passage in Congress. In fact, the entire deficit debate itself revolves, to a large degree, around GDP. If GDP grows faster, tax revenue goes up, and the deficit goes down. Additionally, the main reason why some think budget deficits (and their resultant increases in federal debt) are so bad is that there is evidence that in the long run, shouldering massive amounts of debt can become a significant drag on GDP growth.

In Europe, this understanding of the impact of large debt loads on GDP growth has had catastrophic policy implications. Since the 2008 recession, countries across the continent have relied on austerity to help restore economic prosperity. Austerity is characterized by dramatic cuts to public sector spending (and therefore borrowing) in an effort to reduce an economy’s debt load so as to permit faster future growth. It hasn’t worked. Its defenders relied for years on research about debt-to-GDP ratios indicating that public debt loads in excess of 90 percent of GDP become an untenable drag on economic growth. This research has since been largely disproven, and the notion that austerity can benefit GDP has been seriously questioned. It’s true that the focus on GDP was not directly responsible for Europe’s reliance on discredited research, but it’s also true that if European policy discussions had been more inclusive of alternative metrics of prosperity, austerity would have seemed a lot less palatable. Only a focus on raw growth at the expense of all relevant context could justify biting the harms of increased inequality and reduced quality of life caused by austerity’s steep cuts to social welfare programs.

A single-minded focus on GDP has had similarly pernicious effects on Chinese growth for quite some time. Each year, the Chinese government sets a growth target for the following year and pursues it with an unhealthy fervor. This policy has produced a number of unfortunate consequences, particularly as Chinese growth begins to naturally slow down. First of all, growth targets distract from important structural reforms. Because they’re taken so seriously by both markets and political actors, they push policymakers to place much greater importance on economic status at the end of the current fiscal year than on economic status five or ten years down the road. The economy this policy has produced is dangerously unstable. An unregulated shadow banking industry has gambled on the continued rise of urban property values (among other high-risk securities), which have been artificially inflated by unnecessary government investment in further construction, simply because it boosts GDP numbers in the short term. China lacks a sufficient incentive either to start to regulate its shadow banking industry or to reel in its out-of-control overbuilding because doing so would make it harder to meet the next growth target. Growth targets misalign incentives for localities in other ways, too. They create an incentive to report false data about local economic activity, for example, which makes all policymaking more difficult. Furthermore, they make addressing China’s terrible air pollution nearly impossible by incentivizing the further expansion of unrestricted manufacturing. This same incentive also pushes municipalities to take steps to deliberately hold down wages for the purpose of better attracting foreign companies, distorting local economies and worsening already dramatic income inequality.

Such demonstrations of GDP’s inadequacy have, in recent years, created momentum toward a number of proposed changes to the indicator. These changes tend to fall into two categories. The first involves replacing GDP with a more holistic indicator that considers economic output alongside additional factors like inequality, financial system stability, social welfare and environmental protection. Indicators in this category include the genuine progress indicator (GPI) and the inclusive wealth index (IWI), and they have seen some success. The GPI has been officially adopted by both Maryland and Vermont as their primary metric of economic prosperity, and Oregon and Washington, among other states, have expressed interest in it as well.

Others contend that GDP should continue to be used but should be supplemented by another indicator measuring exclusively non-economic elements of general welfare. The most popular indicator in this category is the social progress index (SPI), though it has yet to see any sort of official implementation. One such indicator has been in official use since the 1970s, however, and that is gross national happiness (GNH). The Kingdom of Bhutan replaced GDP with GNH in 1971 and has professed its satisfaction with the unusual indicator in the decades since. That said, completely replacing GDP with an indicator that doesn’t consider economic activity at all warrants skepticism as a step too far, and Bhutan itself has faced harsh criticism for the move.

Ultimately, policymaking blinded by an incomplete picture of the economic landscape cannot be enlightened through the removal of the picture in its entirety. Rather, policy must be based on an analytic foundation that includes all relevant data. And the data that GDP leaves out is unquestionably relevant to economic inquiry. In fact, perhaps the best argument for its inclusion is that it has been shown to have significant implications for economic activity. From the economic costs of climate change and the drag on growth caused by inequality to the economic loss caused by crime and the productivity gains caused by available leisure time, it’s clear that these excluded factors are not merely topical in economic discussions, but could reasonably be viewed as leading indicators of future economic prospects. Including them in our main economic indicators would align incentives in favor of policymaking with the full scope of its long-term impacts in mind, to the benefit of not just general welfare but future economic growth as well.

Thanks so much for including the Social Progress Index in this thoughtful piece. One correction – the Social Progress Index HAS been officially adopted – by the nation of Paraguay. Read more here: http://www.socialprogressimperative.org/blog/posts/president-cartes-of-paraguay-decrees-use-of-social-progress-index-to-guide-national-development

To make an analogy, using GDP to judge the economic health of a country is as logical as using acceptance rate to determine the selectivity of a college. GDP is a crude aggregate figure that masks important internal trends and obscures context and circumstance.

However, that being said, GDP is useful in the foreign policy sense because it provides a standardized basis for comparing the economic powers of countries. Of course the distribution of that GDP matters as well: a country like China has half the GDP of the United States, but is it half as powerful or influential? Obviously not: the US is more than twice as powerful as China on the foreign policy scene. This is because despite raw GDP, China is still much poorer on average and the GDP is distributed even less “fairly” than is that of the US. This erodes its internal stability, societal cohesiveness, and government efficacy, thus weakening its international projection.