For the last three decades, anti-debt polemics have been the cause célèbre of self-styled “fiscal conservatives.” Over the course of their crusade, deficit hawks have cultivated several strategies to reduce government borrowing and spending. They have tried everything from emotional appeals that invoke scary, big-sounding factoids to more serious econometric studies. Yet all of these approaches fall short upon closer examination. Contrary to the doomsayers, the national debt is not a national emergency—at least, there’s no reason to see it as such in the near or even intermediate future. In fact, austerity is probably the most ‘fiscally irresponsible’ move for the US at present.

It’s quite clear that cutting the national debt has become an article of faith for conservatives. Consider the words of Stephen Moore, the former chief economist at the Heritage Foundation: “In 2015 the US government ran up one of the largest budget deficits in history — borrowing more than $1 billion a day seven days a week and twice on Sunday.” With this folksy statistic as his only evidence, Moore proceeds to advocate for a decades-long regimen of budget-cutting. In his view, the goal of fiscal policy should be to aggressively reduce the national debt over the next two and a half decades until the “debt burden [is] down to … a safe zone.”

Here the intelligent reader should pause and demand elaboration. Why is $8 billion per week too much? It sounds big to the layman’s ears, but government spending always “sounds big.” Furthermore, even if this $8 billion figure does need to be trimmed, how do we go about identifying and justifying a “safe zone” for national borrowing? At no point are either of these claims fully explored as yardsticks for America’s carrying capacity for debt, and yet they are some of the most commonplace fiscal fallacies. The former — framing the debt in terrifying but irrelevant terms—comes in several forms: towering visuals of stacked dollar bills, evocative memes, and analogies that put the national debt in personal terms. These tactics are certainly riveting, but only because they provoke anxiety rather than sober-minded analysis. Unfortunately, such misleading devices are the most frequent and widely-believed ways of talking about the national debt.

Although Republicans are the primary culprits behind intimidating debt-related messaging, Democrats are guilty too. In a 1993 address before a joint session of Congress, Bill Clinton warned that “if our national debt were stacked in thousand-dollar bills, the stack would… reach 267 miles.” The total effect of all these vivid devices and depictions is to create wide-eyed, panicked voters that will back spending cuts. Ideally, people would instead question the macroeconomic relevance of “big” versus “bigger” stacks of dollars into space before they cast their ballots. After all, the average person’s impression of what’s large cannot answer the econometric questions surrounding debt sustainability. But given the state of modern political discourse vis-à-vis US government borrowing, it’s clear that many pundits have a vested interest in debasing the conversation with pathos.

Not all talk of America’s national balance sheet entails this sort of rhetorical flourish, however. There is also a second way of talking about the national debt — using the debt-to-GDP ratio — which has at least the veneer of respectability. The intuitive logic behind this metric is that GDP is a country’s income, and therefore, represents its ability to pay off debt. When debt grows faster than GDP, liabilities begin to outstrip income and the country gets closer to the brink of insolvency.

Of course, it’s not as simple as just stating a ratio: Facts without explanations are meaningless. Moore commits this oversight when he flatly asserts that America’s debt-to-GDP ratio is too high, but fails to elaborate on several crucial points. First, what determines the magic number for debt-to-GDP (Moore’s baseless claim is 50%)? Why exactly are current levels flirting with calamity, if they are at all? Economists struggle with the answer, partially because it is far from clear that there is such a universal “critical point.” An oft-cited 2010 paper on the topic by Carmen Reinhart and Kenneth Rogoff finds that gross debt starts to threaten growth when it reaches 90 percent of GDP. While alarmists have seized upon this figure, subsequent research has cast doubt on a hard-and-fast rule for government spending. Economists at the University of Massachusetts Amherst “replicate[d] Reinhart and Rogoff … and [found] that coding errors, selective exclusion of available data, and unconventional weighting of summary statistics lead to serious errors that inaccurately represent the relationship between public debt and GDP growth among 20 advanced economies in the post-war period.” Multiple other groups of researchers have joined the salvo, and no consensus exists as to when public debt actually begins to cripple economic activity. It is therefore difficult to aim for a safe zone that academic economists cannot identify and which might not be necessary.

Recent events have further belied rather than reaffirmed truisms about debt-to-GDP metrics. The countries that befell fiscal distress in the Eurozone crisis held gross debt that ranged from 40 percent to 110 percent of GDP before panic set in. Such a wide range does not neatly lend itself to meaningful lessons on proper debt levels. Additionally, some middle-of-the-pack countries like Germany remained oases of stability as others became sources of contagion—despite the fact that Germany’s debt-to-GDP ratio was 75% in 2009, 10 points higher than that of troubled Spain and 20 higher than that of distressed Ireland. Hence it’s not clear that austerity is a good or even necessary economic decision when debt-to-GDP ratios are seemingly high. That’s because austerity can cause recessions, and avoiding an uptick in debt by incurring economic harm is often a bad deal. Japan demonstrates that austerity need not be the go-to decision at even high debt levels; the country’s gross national debt is 243 percent of GDP, but with low interest rates, this value is still manageable and necessary. No one is fretting about a surprise Japanese default, and government spending helps to mitigate Japan’s ongoing economic weakness. In terms of creditworthiness, US government bonds are still incredibly reliable, maintaining an AA+ credit rating — even with current gross debt levels at around 100 percent.

While austerity might not be an urgent prescription for the US, there is a case to be made that current borrowing will force an eventual reckoning. The theory holds that government expenditures are unsustainable and will cause problems decades down the road. Corresponding cuts are needed at present in order to fix or forestall this eventuality. The Congressional Budget Office raised these concerns in a 2015 report on long-run fiscal trends, contending that starting around 2020, “debt [will] be on an upward path relative to the size of the economy. Consequently, the policy changes needed to reduce debt to any given amount would become larger and larger over time. The rising debt [cannot] be sustained indefinitely; the government’s creditors [will] eventually begin to doubt its ability to cut spending or raise revenues by enough to pay its debt obligations, forcing the government to pay much higher interest rates to borrow money.” This argument therefore warns that the government’s rising financial burden from debt will eventually outpace the growth of the nation’s economy.

The problem with this analysis is that predicting the macro economy—and the government revenue it provides—decades in the future is the social science equivalent of reading tea leaves. Nobel Prize Economist Paul Krugman has called such estimates an “especially boring genre of science fiction” due to their high variability, and Jared Bernstein, formerly a top economic advisor in the Obama Administration, writes that predictive economics fail beyond a 10-year horizon. If year-on-year growth ends up just a fraction of a percent higher than expected, the debt would be a nonissue. Alternatively, if the world is hit with another large recession, fiscal crises could erupt. While no one knows what will happen years from now (who predicted the Great Recession?), we can be sure that austerity today will harm employment and the economy at large. Does it really make sense to act on an uncertain and likely flawed prediction of fiscal health, especially when such action will cause almost certain economic stagnation in the present?

Perhaps the largest problem in using the debt-to-GDP ratio to justify spending cuts is that it’s an incomplete snapshot. While this ratio does invoke national income and indebtedness, it neglects a crucial variable: interest. The extent to which a country can pay creditors without falling into arrears is highly sensitive to interest rates. If it is the case that these rates are extremely low, borrowing is cheaper, since interest is what the government pays for the privilege of borrowing. Therefore, a drop in rates — say, due to the Fed’s response to an economic crisis — has the practical effect of mitigating the government’s financial liabilities. The US is still feeling the aftershocks of such a crisis, and US monetary policy over the last seven years has been constructed with this in mind. Hence government borrowing has never been cheaper.

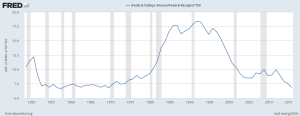

The graph to the right, made using Federal Reserve Economic Data from the Federal Reserve Bank of St. Louis, demonstrates as much. It depicts net interest payments as a percentage of total federal revenue over time. The current figure is in the ballpark of 7 percent, which is lower than it’s been in the last four

decades. Notice how the graph remained steady during the recession. That’s because, although tax revenue decreased due to economic contractions, the Fed reduced interest rates enough to compensate. While many fiscal conservatives claimed that the Great Recession meant that the federal government needed to cut back, the ironic truth is that the aftermath of the Great Recession has helped expand the US government’s short-term ability to sustain debt. Although interest rates are starting to inch up, this leeway still very much exists: Rates are far from normalized, the deficit is 70 percent lower than its 2009 recession peak, and continuing economic weakness makes government borrowing a worthwhile tool.

decades. Notice how the graph remained steady during the recession. That’s because, although tax revenue decreased due to economic contractions, the Fed reduced interest rates enough to compensate. While many fiscal conservatives claimed that the Great Recession meant that the federal government needed to cut back, the ironic truth is that the aftermath of the Great Recession has helped expand the US government’s short-term ability to sustain debt. Although interest rates are starting to inch up, this leeway still very much exists: Rates are far from normalized, the deficit is 70 percent lower than its 2009 recession peak, and continuing economic weakness makes government borrowing a worthwhile tool.

Given the aforementioned evidence, running a budget surplus and chipping away at the national debt does not seem to be immediately necessary. In fact, it might even be self-defeating; budget cutting could actually exacerbate the debt situation. Krugman gave an excellent exposition of this very idea in the New York Times, using Greece to describe the negative consequences of cutting spending without help from monetary policy. He argues that because austerity hurts the economy and thereby reduces tax revenue, it both raises and costs money. Accordingly, rapidly moving from a deficit to a balanced budget shrinks GDP without immediately decreasing the debt. As Krugman points out, this means that the debt to GDP ratio initially goes up in an economy weakened by austerity, because GDP drops while the debt remains the same. This is exactly what’s happening in Greece, where attempts to raise the surplus by one percent could cause a five-point rise in the debt-to-GDP ratio. The fiscal situation worsens even more after accounting for the deflationary effects of austerity. When cutbacks hurt economic activity, price levels begin to decline. A trend of decreasing prices causes people to delay purchases, since their dollars are worth more tomorrow than today in real terms. Less consumption and more savings exacerbate already anemic demand. The result, as Krugman states, is a smaller economy with the same debt — a categorical loss.

The only exception to this pattern is if monetary policy can lower interest rates and mitigate the economic costs of tax increases and/or lower spending. But interest rates are stuck at near-zero percent and cannot go significantly lower — negative rates would take from savers and investors, causing them to withdraw their money from the financial system. So the Fed is no help, and proposed budget cuts would cripple aggregate demand in its already weak state; America would only be backpedaling. This is exactly what we see when we look at the data: Greece’s debt-to-GDP ratio has failed to fall despite several rounds of harsh austerity. Instead, budget slashing simply caused its real income to crater, dropping by 25 percent in just a few years. It seems that fiscal conservatives have formulated a plan of one step forward, two steps backward.

There is a level on which austerity appears sensible for the United States. However, it is a level fraught with intuition, misdirection, and misunderstandings. Rationales for rolling back spending come with the sheen of responsibility. They seduce both lay people and economists. They feed hyper partisanship and help politicians posture. While these approaches are persuasive, their logic is flawed. It is public policy malpractice to see dangers where there are none —doing so raises the risk that the United States flees toward even greater fiscal and economic hazards. So the next time some politician, polemicist, or Average Joe rails against the big spenders in Washington, do not be seduced. Anti-spending crusaders are touting a solution in search of a problem.

A main street liquidity complement(individualized NIT) and a flat-line or decreasing debt/gdp (when not in recession) may leave more headroom [1,2] than yet another round of quantitative easing, expanding the Fed balance sheet and deficit spending that increases the annual interest due, faster than inflation.

[1] How The Economic Machine Works | Ray Dalio

[2] The Truth About Central Banking and Business Cycles | FEE

The national debt is meaningless. Why would we need to borrow in our own currency? The answer is that we don’t.

People have been predicting debt problems since the 1940s and yet they never materialise. Look at this article:

http://mythfighter.com/?s=ticking+time+bomb

Fact is, the debt is simply a stock of money in savings accounts at the Federal reserve.

The government spends by printing. Look at this video

https://www.youtube.com/watch?v=odPfHY4ekHA

go to 8:00

Even Greenspan admits it

https://www.youtube.com/watch?v=-_N0Cwg5iN4

We spend by printing, we don’t need to borrow, we choose to sell bonds for the sake of investors. Google Modern Monetary Theory.