The AI wave rippling through the US economy has raised both excitement and alarm. As an immense amount of capital changes hands between companies in the industry and investments in AI make up an increasing share of US GDP growth, some analysts now predict an AI bubble. While there have previously been disruptive paradigm shifts like cloud computing and cryptocurrency, what distinguishes this paradigm shift is the way in which AI investment has become an industry-sanctioned band-aid on an otherwise bleeding US economy. Despite bubble speculation and potential overvaluation, AI has emerged as a flawed but essential driver of innovation and economic renewal in a country that desperately needs it.

To understand the implications of AI’s recession-cushioning capabilities, it is important to analyze the American economy more broadly. Since taking office in January 2025, President Donald Trump has announced double-digit, country-specific tariffs on America’s top trade partners alongside an array of sector-wide policies, including a declared 100 percent tariff on patented pharmaceutical products from companies that do not rely on US manufacturing. The administration has also toyed with, adjusted, and rolled back promises to use tariffs to coerce Mexico and Canada into strengthening border security earlier this year.

At the same time, the US job market has experienced a recent slowdown, with the unemployment rate reaching 4.4 percent in September: the highest since October 2021. The Federal Reserve System has even tried to ward off an employment crisis through cuts to the federal funds rate. Volatile tariffs, combined with the Fed’s passive “wait-and-see” approach to the unemployment landscape, have brought the future of the US economy into question.

US economic growth, however, does not show signs of stagnation. The S&P 500 has grown 16 percent from January through October 2025, nearly 6 percent above average returns over the past 70 years. The political factors that should be creating shortfalls within the American economy are outweighed by a dominant force: AI spending.

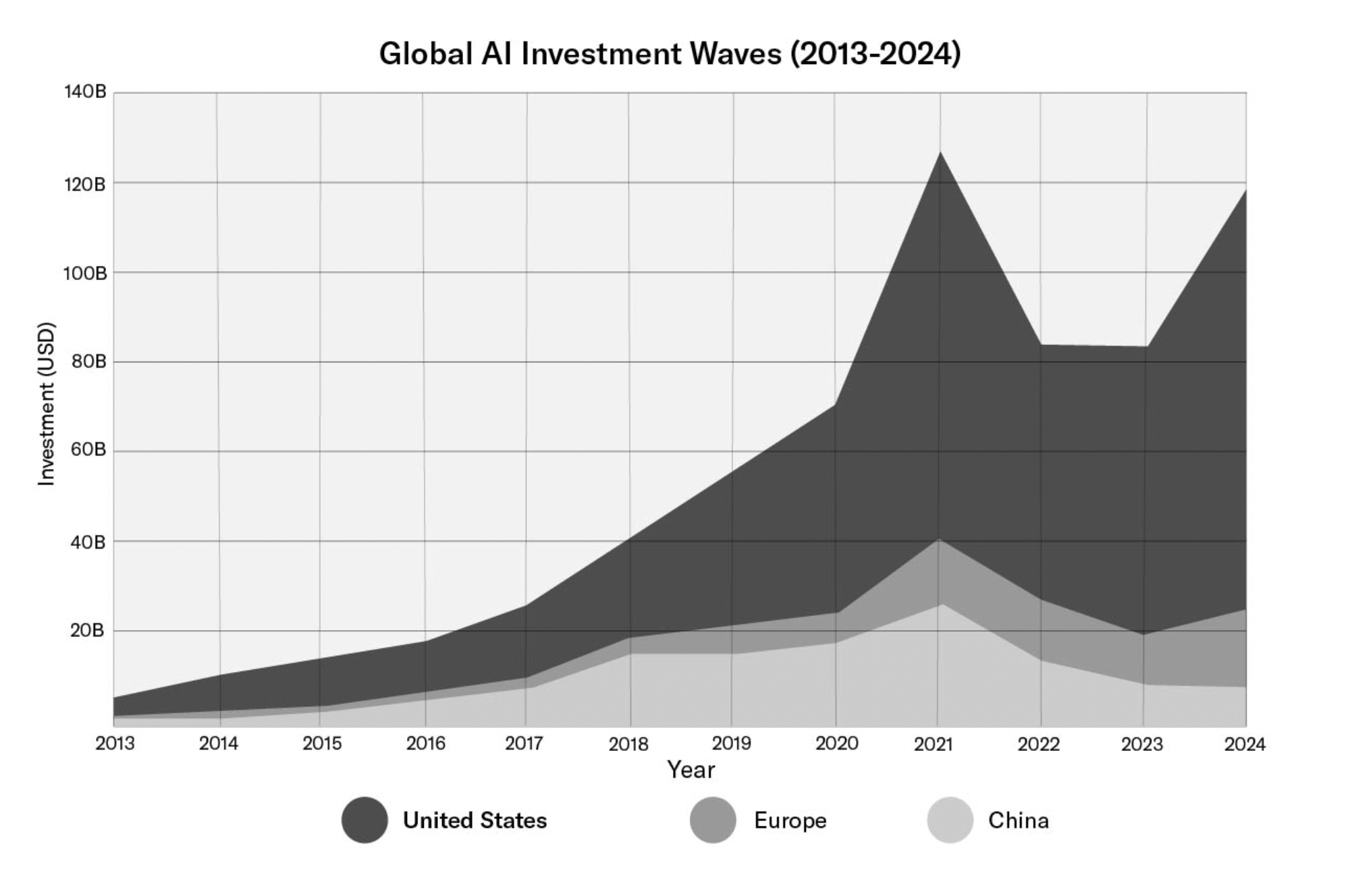

In 2024, well before this year’s mega-deals between leading tech companies, the US private AI investment market alone was valued at $109.1 billion. Only a year later, Nvidia, the chipmaker powering much of the AI ecosystem, is valued at nearly a third of US GDP growth this year.

The disproportionate role of AI growth in the GDP growth has elicited both skepticism and conviction from the investors and individuals spearheading the AI movement. Deutsche Bank reported that the AI boom could produce an $800 billion separation between revenues and investments that would plunge the economy into a deep recession. OpenAI CEO Sam Altman also explained in August that he believes investors are “overexcited about AI,” which can lead to recession-inducing bubbles. Others, however, believe the opposite, with investor Michael Pecoraro arguing that leading AI companies are creating “actual demand” by generating “real revenue” through long-term contracts with customers.

Despite concerns about overvaluation, there is a general sense of hope for AI’s role in the future. Altman explained that “AI is the most important thing to happen for a very long time,” and he’s right. On even the least developed end of AI, the fact that individuals have created a system capable of learning, understanding, and developing new ideas independent of human guidance makes it commensurate with the invention of the wheel or the discovery of the double helix. In this sense, even if the current AI products are overvalued, the tidal wave of investment will provide essential scaffolding for a technology that could mark the next chapter of human civilization. Beyond AI’s social implications, even a potential bubble creates meaningful economic benefits. Venture capitalist Hemant Taneja asserted that although such a bubble could create economic upheaval, it would distill the AI landscape to the companies innovative and resilient enough to survive and change the world.

Considering its social and economic significance, our understanding of AI’s economic impact needs to be reframed. While the current landscape may resemble a bubble, any suspicion of overvaluation can only be confirmed if such a bubble bursts. Until then, discussions surrounding AI should revolve around its clear promises for the future instead of the current market frenzy. Not only does the technology serve as an economic catalyst for growth and a beacon of innovation in an otherwise stagnant US economy, but it could also represent a new chapter in human progress.