Walking into MetroMart on Thayer, I pick up my third iPhone charger of the semester. I’m a forgetful person usually, and iPhone chargers seem to have an uncommon knack of disappearing into the gaping maw of the Sun Lab or the SciLi, never to return. The small, green LCD screen on the cash register flashes about $15 and change. A moment later it ticks up to over $16. Rhode Island, having one of the highest sales taxes in the nation – at 7% – remains economically uncompetitive because of these taxes, and it’s high time the state legislature realizes that. But luckily for businesses and consumers, one can choose to move out of Rhode Island if you want a lower cost of living for a higher quality of life.

The Marketplace Fairness Act (MFA) would change that. The argument goes: so called “brick-and-mortar” stores are unfairly hurt by the fact that states only collect sales tax from stores with physical presence within their borders. Retail websites, like Amazon, need only a physical presence in one state to sell to every other one, effectively tax-free. This bill would allow states to collect sales taxes from online retailers who sell to their citizens. This supposedly levels the playing field between, for example, a PayLess in downtown Providence and a Zappos.com located in Nevada but selling to a Rhode Islander.

It is a well-known fact of political science that something is bad policy if you can explain why it is bad using alliteration. Unfortunately for the Act’s proponents, this piece of legislation falls into that category, seeing as the Internet Sales Tax is a raw deal for the citizen on three fronts: Cost, Cronyism and (the) Constitution.

While I could rest my Case right now, for the sake of Completeness, I’ll go into why this alliterative axiom is true in this case specifically.

The cost argument rests on a simple fact: taxing something raises its price. Sales taxes especially are a regressive form of taxation, hurting the poor the most (the $1 surcharge on children’s shoes hurts a working single-mom more than a rich suburban family). Even if there are sales taxes for some businesses and not others, our goal should be to lower sales taxes in order achieve ‘marketplace fairness’, not increase the burden on the poor. An interesting fact should be noted here, however. Technically, not paying sales taxes is a crime now in 45 states and the District of Columbia. The burden of collecting that tax falls on the individuals, however, whose responsibility it is to report their online purchases to state tax collection agencies. Unless you really like giving the government money though, you don’t go out of your way to report purchases government would otherwise have little capability of discovering. This makes internet sales de facto untaxed. The MFA would just give states and localities an effective way of implementing these laws.

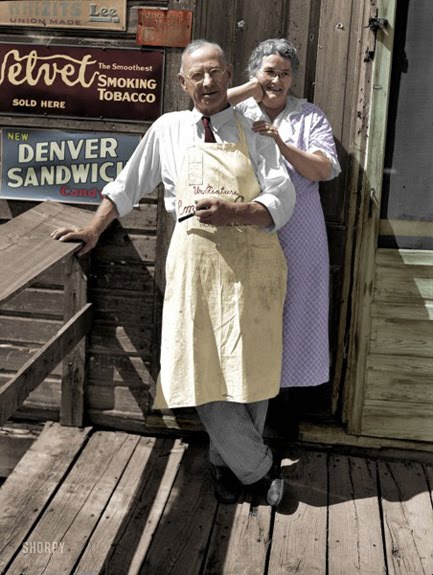

This leads us to the second C, ‘Cronyism’. There are over 9,000 sales tax jurisdictions in the United States. Many internet retailers are small businesses, sometimes family-owned, consisting of a handful of people. They don’t have accounting departments – they have fathers-in-law with calculators. Complying with thousands of local and state tax regimes will impose a huge cost, perhaps huge enough to put many small retailers out of business. The types of businesses that will benefit from this legislation, in fact, are those that can absorb the price of tax compliance – namely behemoths, like Amazon. It should come as no surprise then, that Amazon is lobbying vehemently for the tax – not only because it has already been slapped with so-called ‘Amazon laws’ that are specifically designed to grab taxes from the largest online retailer, but also because it would put many of its smaller competitors out of business. Funnily enough, Amazon will also profit from this law directly, as it has already announced that it will provide accounting services to help people comply with the thousands of new regulations they will have to deal with. Though the bill contains a provision exempting businesses with less than $1 million dollars in out of state sales from the tax increase, too many small businesses fall within the taxable category. They will be negatively hurt by this policy.

Finally, even beyond lining the pockets and cementing the monopolies of online behemoths over the ‘brick-and-mortar’ stores the law was designed to ‘protect’, the Marketplace Fairness Act is in a Constitutionally iffy situation at best. The Interstate Commerce Clause of the Constitution states that Congress has the power “To regulate Commerce […] among the several States.” This is an enumerated power of the federal government, and according to the precedent known as the Dormant Commerce Clause, it means that state governments cannot restrict interstate commerce. In a case in 1992, the Supreme Court decided that North Dakota could not tax Quill, an office supply retailer, because though Quill licensed computer sales software to residents of the state, its headquarters were elsewhere. So, North Dakota imposing a tax on those software-based sales would effectively be a tariff against interstate commerce, and was therefore ruled unconstitutional. A similar case in 1967 ruled that you couldn’t tax corporations that sell in your state via catalogs and magazines – when Sears used to do that kind of thing. In its 1992 case, the Supreme Court explicitly said Congress could overrule its decision through legislation. But the current court may not be so kind if this law ever makes its way up to it. The gray area that the law inhabits should give supporters pause regardless.

The three C’s of the proposed tax’s effects of the Marketplace Fairness Act imply that it is fundamentally bad policy and fundamentally unfair. It is also fundamentally unpopular. I would hope that even those that support revenue-raising measures and fuller government coffers realize that taxing the internet is not the best way to do so.