Americans have prized individual liberty since the nation’s founding. Naturally, many people are suspicious of the government collecting their data. According to a 2015 Pew Research Center survey, a majority of Americans disapprove of the US government’s collection of telephone and internet data, and over 90 percent of Americans “say it is important to control who can get their information, as well as what information about them is collected.”

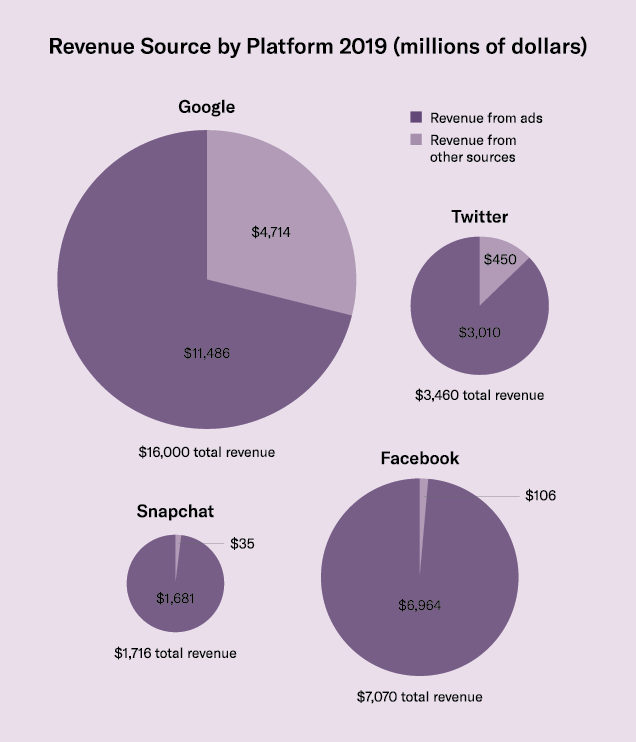

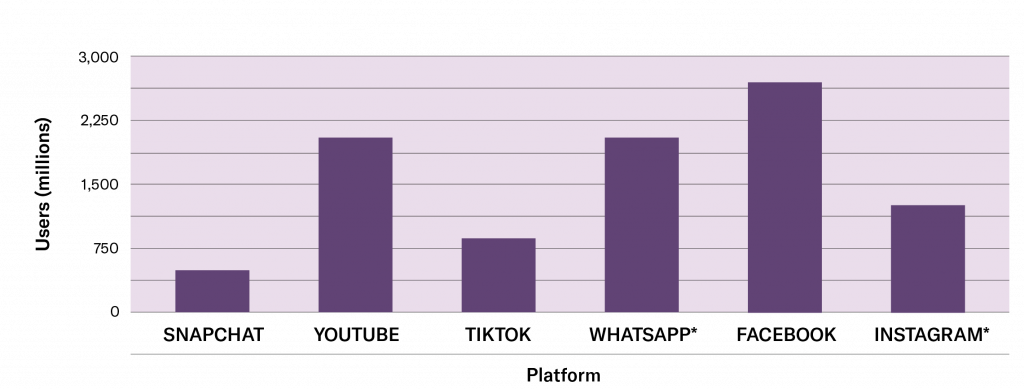

However, there is a force in American life that threatens data privacy as much as the government does: tech companies. Though Americans are concerned about tech companies’ collection of data, which can be tied to a relentless pursuit of profit, almost nothing has been done to curtail this phenomenon. Google and Facebook record every website their users go to, every photo they look at (and for how long), and much more. However, rather than storing and recalling taped phone conversations only in instances where, say, national security is threatened, as the NSA claims to do, these companies immediately put the data to work to help target ads and suggest content—a practice which has become essential to their business model and their profits.

Tech companies like these know more about users than most people realize, from the kind of toothpaste they use to their sexual orientation. The use of this data can easily become problematic. For example, a person who is recovering from an addiction to alcohol may get an ad for a special deal on their favorite whiskey brand or see suggested videos of celebrities having fun at a bar because they have expressed interest in alcohol in the past. Google Maps might even tell them when they are close to a liquor store. These kinds of digital suggestions and reminders are not only detrimental to a person’s recovery and wellbeing, but they compromise the consumer’s privacy.

No single entity should have this much knowledge and power, especially not trillion-dollar corporations with few obligations beyond appeasing their shareholders and maximizing their profits. With the current landscape of ineffective mediation and sparse government action, a federal “data tax” on tech companies’ collection of user data is necessary to curtail these companies’ mass data collection and protect the fundamental liberties of Americans.

A data tax is not a novel idea. Politicians, particularly from local governments, have been proposing the solution for years. Similar taxes, including severance taxes, are already in use in some states and provide a basic model for how a data tax might function. A severance tax is a tax on non-renewable resources and is most often implemented as a measure to gradually disincentivize natural gas and oil extraction. These taxes—which normally range from one to six percent of the value of the goods—generated nine billion dollars in revenue in 2017. While severance taxes were mostly created to raise state revenue, they have also slightly reduced oil and gas extraction in certain states. Economists estimate that the “elasticity of oil drilling with respect to severance taxes is between -.3 and -.4”, meaning that a “one percent increase in the severance tax rate would reduce drilling by about 0.3 to 0.4 percent.” So, while they are bad news for oil companies, severance taxes have been successful in raising revenue and slowing down the extraction of pollutive natural resources. A data tax would have a similar goal: to raise tax revenue while decreasing data collection by tech companies.

There is good reason to believe that a data tax could be even more effective at curtailing data collection than severance taxes have been for reducing drilling. First, data collection is likely to be more sensitive to changes in price compared to oil drilling, given that oil is a commodity with a relatively stable price. The value of data, on the other hand, is tougher to quantify. A data tax would force companies to carefully consider which consumer data is most valuable and only collect that, cutting back on the accumulation of other, less lucrative user information. Second, while severance taxes usually charge a flat rate for each barrel of oil or ton of coal, the data tax could operate using a tiered model. Companies should be permitted to collect some data on their users as a means of upholding their legal right to generate revenue from consumers’ use of digital products. However, when a firm begins to collect data over a certain predetermined threshold, they would be subject to a data tax levied at a proportional rate. This taxation model would operate similarly to the progressive tax system in the US. The more data over the threshold a company collects, the more that data is taxed. Under this system, companies will be able to collect the data they need, but not all the data they want.

With billions of dollars at stake, tech giants like Google and Facebook would not accept these newly imposed taxes without a fight. Any lawmaker who proposes a data tax can expect companies to do all they can to derail the legislation. Tech companies are capable of spending massive sums on lobbying to influence politicians and impact potential legislation. Over the past decade, the seven largest tech companies in the US—including Facebook and Google—have spent over half a billion dollars on lobbying and advocacy. It is also conceivable, and even probable, that tech companies affected by the data tax would challenge its constitutionality, similar to how severance taxes have been challenged. Yet, severance taxes were still found constitutional, as a data tax might be, in the Supreme Court. Given that a data tax could meaningfully decrease these company’s profits, there is no question that they will be willing to spend as much as it takes to stomp out the idea.

Aside from these challenges posed by tech companies’ inevitable resistance, there would still be implementation issues to address. Fundamentally, there is the question of how to record the amount of data being collected by companies. Should the federal government allow companies to self-report their data collection practices or does that just open the door for fraud and tax evasion? If the government decides to monitor the companies’ data collection themselves, do they even have the necessary technology to do so? Also, how does the government measure data in order to tax it? While current technological and legal analyses fail to provide certain answers to these questions, they should not stand in the way of something as important and necessary as a data tax. Once the logistics have been worked out, the tax will be well worth it.

A data tax is a big idea. It would drastically reshape the tech industry. It would alienate some of the wealthiest people in the world and infuriate prominent conservative politicians, but it is necessary. At a time when every state in the US is experiencing a decline in tax revenue and unemployment is coming off record-high levels, the billions of dollars in proceeds from this tax could be put to good use. As more of our lives shift online, the market for data will continue to grow and the algorithms that extract and use our data will become increasingly sophisticated. We need to start thinking of these companies’ mass collection of data as a true existential threat. Considering these stakes, a data tax is not an extreme idea at all.