The roofs over several docks at Port Fourchon were stripped away by early afternoon. Hurricane Ida had produced a 12-foot storm surge and sustained 150 mile-per-hour winds that battered buildings, scattered equipment, and submerged large swaths of land under a layer of warm Gulf water. The sun had not yet set on August 30th, but the gateway to 90 percent of oil and gas extraction in the Gulf of Mexico was without electricity and running water, its pipelines shut down and its crews shut in. Ten days later, 75 percent of production was still offline.

Ida was not the first hurricane to cripple natural gas production, and it certainly will not be the last. Scientists report that increasingly erratic weather caused by climate change presents new challenges to offshore and shoreline oil and gas infrastructure. But in recent months, natural disasters play just a few notes in a symphony of causes of skyrocketing natural gas prices, which have grown by as much as 600 percent in European markets and elsewhere since February. A frigid winter in Europe and the American Northeast led to higher demand for natural gas, a factor that will likely only increase in magnitude as climate change accelerates. Limited exports from Russia, growing demand across Asia, and production cutbacks due to pandemic-induced financial losses also play roles.

As Ursula von der Leyen, President of the European Commission, noted on October 13th, “The current situation is due to our overdependence on fossil fuels. While gas prices have rocketed, renewable energy prices are stable.” Although natural gas is uncompetitive in energy markets, nearly every country’s insufficient investment in renewables leaves consumers with little choice but to pay more to heat their homes. These high prices present an unexpected opportunity for aggressive climate policy. Expensive natural gas now and for the foreseeable future should be the impetus governments need to greatly accelerate the transition to renewable energy.

Despite its rosy marketing as a “bridge fuel,” or temporary fix for our energy needs while the world weans itself off of oil and coal, natural gas bears no resemblance to renewable energy sources. It is true that natural gas consumption emits roughly half as much carbon dioxide as that of oil. However, this claim of sustainability intentionally ignores the fuel’s single largest problem: methane, a greenhouse gas that traps heat in the atmosphere at 80 times the rate of carbon dioxide. Natural gas is 70-90% methane, establishing it as a uniquely large emitter. Methane is such an effective greenhouse gas that leaking in natural gas infrastructure of just 2 to 3 percent of fuel results in the same amount of warming as if coal was used instead. In the United States, the world’s largest gas producer, 3.7 percent of gas originating in Texas’s Permian Basin leaks into the atmosphere. In Russia, the world’s second largest producer, the leakage rate is as high as 7 percent.

Along with claims about emissions, claims about the longevity of natural gas usage are manufactured, too. It is no temporary fix. As environmental activist Bill McKibben said in a recent talk at Brown University, “If we do not win soon, we do not win.” Yet natural gas plants built now could still be running in 2081, using the lifetimes of current plants as a guide. Once developers sink millions into an energy project, it will run until it is no longer profitable, and potentially even after that. Through the lens of our rapidly destabilizing climate, 60 years ahead might as well be a thousand. Fossil fuel giants such as ExxonMobil and Royal Dutch Shell are spending millions on lobbying and advertising to keep concerns about natural gas emissions at bay. This money aims to ensure a future for the fuel, not the humans that rely on it. This battle over energy policy pits the interests of industry and forces of inertia against ecological collapse and global instability. Fossil fuel companies are being deceptive, and it is working.

The same day Hurricane Ida ravaged Port Fourchon, the Biden Administration moved to lease 80 million acres in the Gulf of Mexico for oil and gas drilling. This area is expected to provide 4.4 trillion cubic feet of natural gas over the next fifty years. Before Biden, the Obama Administration increased subsidies to the natural gas industry in light of hydraulic fracturing, or “fracking,” a method of extraction which cheapened the fuel and greatly expanded its production. The United States is not alone: The embattled Nord Stream 2 pipeline from Russia to Germany cost $11 billion and has yet to transport a single drop of gas. This year, Qatar committed $29 billion to construct a liquefied natural gas plant that will be the world’s largest upon completion in 2027. To keep global warming under the 2 degree goal established at the Paris Climate Agreement, major polluters like Russia, the European Union, and the United States need to rapidly phase out existing fossil fuel infrastructure. Instead, they are doubling down.

Climate change has been on the horizon for decades, so a host of market-ready alternatives now exist. The world is entering a new era of cheap renewable energy production and novel storage and transmission techniques. The nations that pollute the most are also the nations where wind and solar energy cost less than natural gas per unit of energy generated. While the political appetite for nuclear energy has weakened considerably in recent years, it too is financially competitive with natural gas. Critics of renewable energy often claim that wind and solar energy cannot deliver electricity across variable weather conditions, but this concern is increasingly irrelevant. The cost of grid-scale batteries plummeted by 70 percent between 2015 and 2018, enabling the planning and creation of massive energy storage units in the United States, France, and South Africa, among others. Many of these units can power hundreds of thousands of homes for hours at a time. Paired with investment in high-voltage transmission lines that transport energy from particularly sunny and windy locations to areas with high energy usage, grid-scale batteries are a crucial piece in the puzzle of a global transition to green energy.

Port Fourchon will be mostly submerged into the Gulf of Mexico in the coming several decades due to rising seas, a casualty of the industry that created it. Nevertheless, we are not helpless. Federal funding for new solar and wind projects will accelerate a global transition to green energy, but it can only work paired with a new, climate-first framework that employs the same government mechanisms for directing economic activity that have been used for centuries. This framework incentives pro-climate behaviors and punishes anti-climate actions on the largest scale. Companies that drastically reduce their fossil fuel consumption would remain eligible for grants for their research and funding for their projects; companies that take insufficient action would be taxed and denied federal money through loans and subsidies. Nations would issue grants for the continued development of grid-scale batteries and build high-voltage transmission lines that reflect the prime locations for renewable energy plants. Nations and global consumers alike need to recognize natural gas as part of the existential fossil fuel problem and organize against it. After all, if we do not win soon, we do not win.

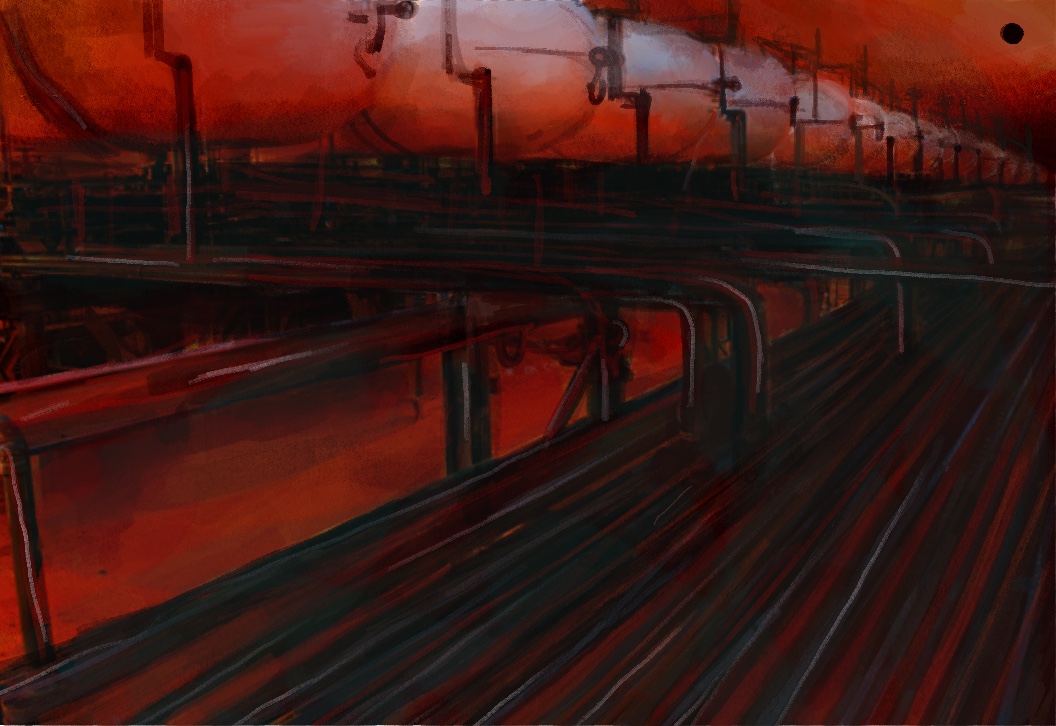

Original illustration by Caroline Zhang