The world no longer runs on just oil but on semiconductors. These miniscule chips play a role in most modern inventions––facilitating the use of the internet, flying drones, and most notably, powering the next generation of AI models. Cutting-edge AI has created potentially radically transformative tools that have already posed philosophical challenges to the concept of intelligence––launching ChatGPT, transforming how doctors detect cancer, and opening the door toward new military capabilities such as autonomous weapons. And what AI developers want more than anything else is greater computing power, which comes from smaller, stronger, and more plentiful semiconductors. In fact, the capacity of semiconductors is cited as a key factor in AI development and performance. As semiconductors gain an increasingly important role in promoting the United States’ technological progress and the security of its digital infrastructure, the country’s ability to rapidly develop and use semiconductor technology will be a determinant of whether it will play a role in the next frontier of computing.

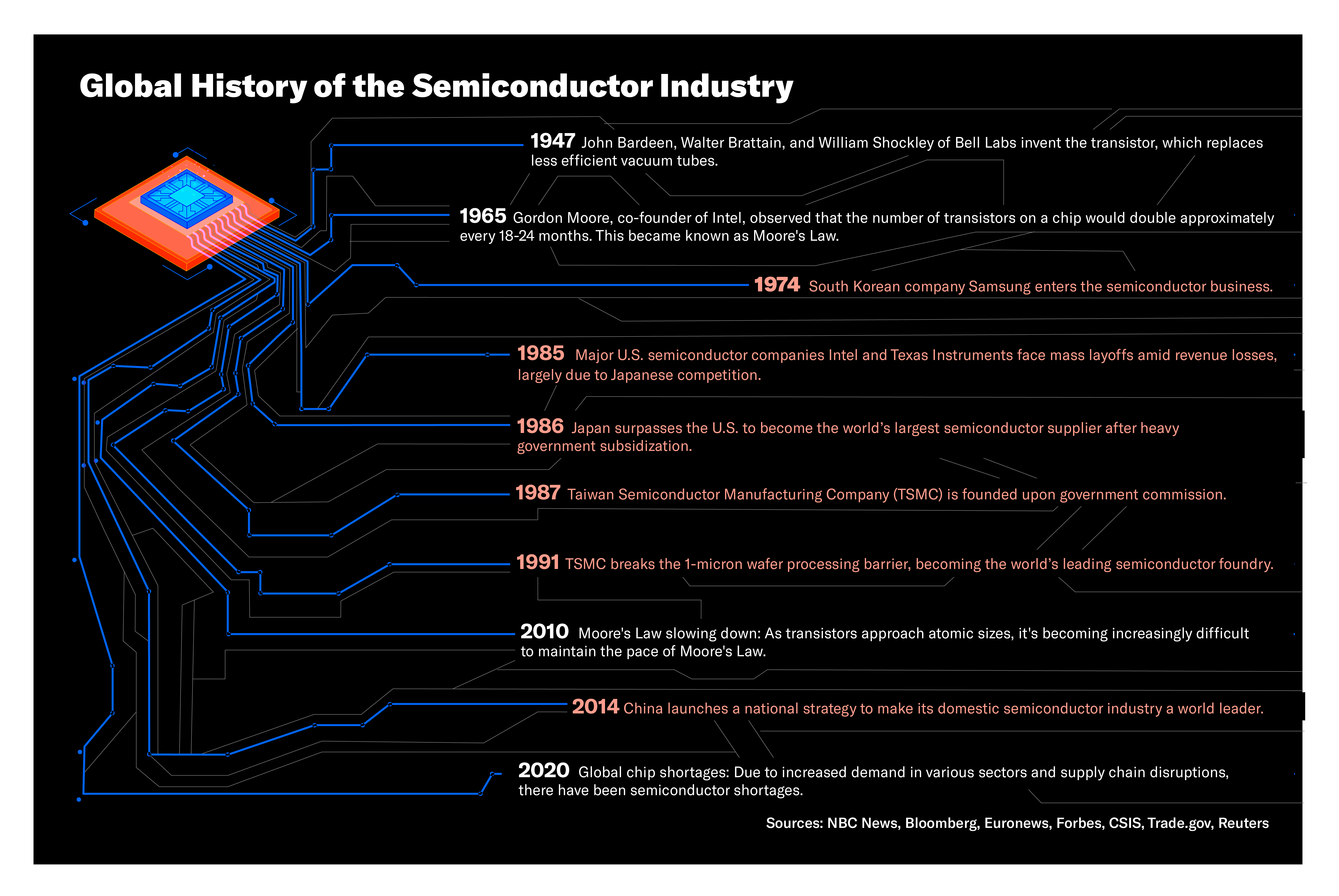

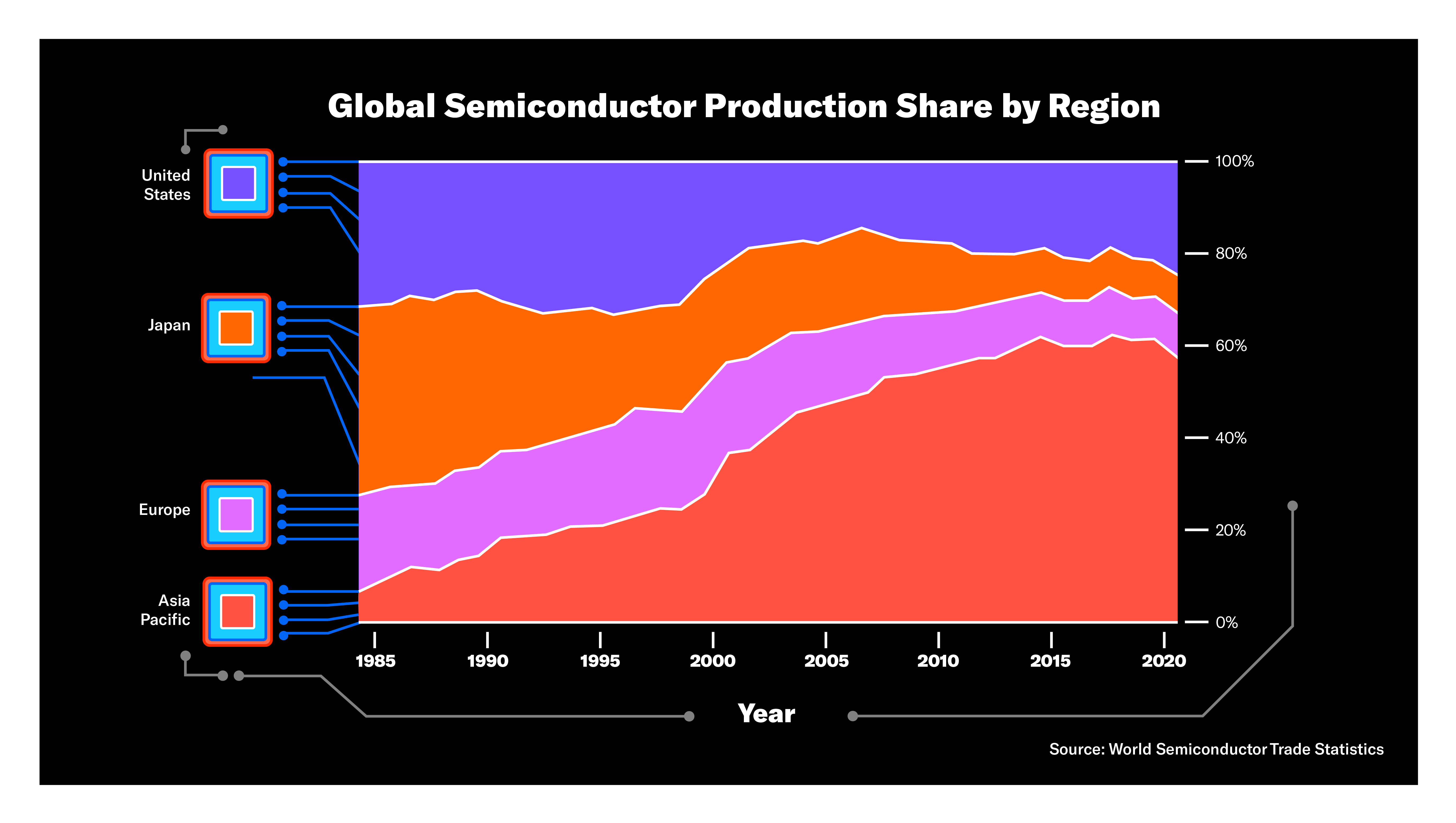

Here lies the problem: The United States is almost entirely reliant on just a couple of companies to produce chips. Without any governmental support, the semiconductor manufacturing capacity of the United States declined from 37 percent of the global share in 1990 to just 12 percent today. Moreover, the United States holds practically zero presence in the manufacturing of cutting-edge chips that power our most transformative technologies in AI. In contrast, Taiwanese companies account for 68 percent of the total manufacturing market share, and one such firm, Taiwanese Semiconductor Manufacturing Company (TSMC), is responsible for around 90 percent of cutting-edge semiconductor manufacturing while the remaining semiconductors primarily come from South Korea’s Samsung.

In normal conditions, American reliance on foreign production may not be cause for concern. After all, semiconductor manufacturing is an industry that heavily rewards economies of scale, even more so than other precision manufacturing. To elucidate this point, current cutting-edge transistors used in the latest Nvidia H100 graphics cards are around the 4nm level (for a little perspective, a human hair is roughly 80,000-100,000nm wide). The problem with a lack of domestic production in the United States, therefore, is not in the economics, but rather, in the geopolitics.

East Asia is an increasingly volatile region within the growing Chinese sphere of influence. Taiwan, or Chinese Taipei, is internationally recognized as part of the People’s Republic of China (PRC), which controls the mainland. Functionally, however, Taiwan acts as an independent state that is more politically aligned with the West than with the PRC. Consequently, the United States has maintained political and militaristic support for Taiwan, even vowing to defend it in the event of a Chinese invasion. Despite this rogue province dynamic and President Xi Jinping’s increasing focus on reunification of the island with the mainland, China, like the United States, buys most of its high-end chips from TSMC. The “silicon shield” theory posits that the Chinese economy’s reliance on Taiwanese chips deters it from taking extreme action against Taiwan. But while this dependence may be staving off blatant escalation that could lead to an invasion, it does not protect Taiwan from economic coercion.

The constant threat of Chinese diplomatic action against Taiwan—although creating strategic vulnerability for the United States due to its reliance on Taiwanese chips—has not yet boiled over into outright conflict. It has, however, led to speculations about future clashes, especially in light of increased Chinese intimidation tactics. The extreme end of possibilities would include a Chinese blockade, preventing Taiwan from engaging in trade with the West. Such an action would leave the United States in a position to choose between breaking the blockade militarily, threatening war (notably already under a strategic disadvantage), or being cut off from the provider of nearly all of its advanced computing supply while exploring a diplomatic solution—a move that would inevitably devastate the economy of the US and the world. In any case, it’s not the best idea for the main manufacturing hub of one of the most vital components of an increasingly technologized economy—not to mention military—to be located directly offshore from a potential adversary in an unstable region.

Incentivizing the return of chip manufacturing back to the United States and its allies is a crucial step toward ensuring America can reliably maintain its technological prowess and weather possible attempts of Chinese geopolitical coercion. One of the most important options available is domestic industrial policy. Recently, a good step was made with the CHIPS and Science Act (2022). This rare piece of bipartisan legislation provides $52.7 billion in funding for the onshoring of semiconductor manufacturing split between $13.2 billion for research and development (R&D), $39 billion for manufacturing, and $500 million for solidifying the international supply chain. Despite bipartisan support, however, the bill is not without its critics.

High-profile detractors of the bill, including Senator Bernie Sanders (I-VT), believe that the government’s proposition amounts to corporate welfare. This argument stems from the view that the CHIPS Act—packaged with taxpayer money—unfairly benefits a single company: Intel Corporation. After all, Intel is the only US-based manufacturer that has the capabilities to compete in cutting-edge chips after Advanced Micro Devices spinoff and UAE-owned Globalfoundries dropped out of the race. As such, Intel will without a doubt be one of the biggest beneficiaries of the CHIPS Act. Is this corporate welfare? Possibly, but there is reason to believe it is still a good policy.

First off, while Intel is in a position to benefit from the CHIPS Act, the bill itself does not directly allocate any money to Intel or to any other company. It thus allows for a level of competition often absent when the government tries to “pick” winners. More importantly, what pundits fail to consider is that, as mentioned previously, the chips industry has barriers to entry that are uniquely high and economies of scale that are absolutely necessary. Consequently, government support is vital; the amount of specialized equipment, facilities, and logistics going into chip manufacturing necessitates reliable political and capital support. Demonstrating this point, even with cooperation from US national labs, Dutch semiconductor firm ASML invested $6 billion and 17 years of R&D to produce Extreme Ultraviolet Lithography (EUV) machines. These machines are each sold for $200 million dollars, but utilized in just one step of the fabrication process.

It is no surprise, then, that the two biggest foundries—Samsung and TSMC—both had robust support from their respective governments. Chris Miller, Associate Professor at the Fletcher School at Tufts University, writes about this support in his book Chip War. Upon Samsung and South Korea’s initial foray into semiconductors. “[The South Korean government] had promised to invest $400 million… Korea’s banks would follow the government’s direction and lend millions more… As in Japan, therefore, Korea’s tech companies emerged not from garages, but from massive conglomerates with access to cheap bank loans and government support.” Similarly, “the Taiwanese government provided 48 percent of the startup capital for TSMC…The rest of the capital was raised from wealthy Taiwanese who were ‘asked’ by the government to invest.” Semiconductors are not an industry built off of free market competition but one reliant on the government to stand behind it.

It is impossible for independent US companies to continue to compete in an industry that favors incumbents with powerful backing. The US government’s $52 billion contribution is not close to enough—especially with leading actors like South Korea who have pledged $450 billion over the next decade to their domestic companies. However, the CHIPS Act is a vital step towards a strategic imperative for the United States. As geopolitical tensions rise and the global power distribution shows signs of shifting, the United States should make another move before cracks start to show. It is through semiconductor dominance and the subsequent technological dominance it permits that the United States can remain a foremost power in the world.