In modern capitalism, the rich getting richer has become a regrettable truism; nowhere is this undeniable truth more evident than in the United States’ current tax policy. From the late 20th century onward, overall tax rates on the richest 400 households in the US have plunged, progressively decreasing from 70 percent in 1950 to 47 percent in 1980 to as low as 23 percent in 2018. The regressive nature of the American tax system today, particularly as it affects wealthy elites, has led poorer households to often pay cumulatively lower rates than their better-off counterparts, due to the positional ability of the rich to take full financial advantage of corporate, estate, and related tax breaks. As a result, lower and middle-class Americans have rightfully come to perceive tax cuts for the upper class as a counterproductive economic phenomenon.

To put it bluntly, the theory that undergirds this phenomenon, dubbed “trickle-down economics” by its myriad critics, is a macroeconomic fallacy. At its core, trickle-down theory invokes supply-side economics in contending that the imposition of substantial taxes on higher-income individuals is inimical to economic growth. Instead, proponents of this school of thought advocate the implementation of lessened taxes on high earners to incentivize business expansion and investment, with the idea that this growth will trickle down to lower earners in the form of financial and occupational benefits.

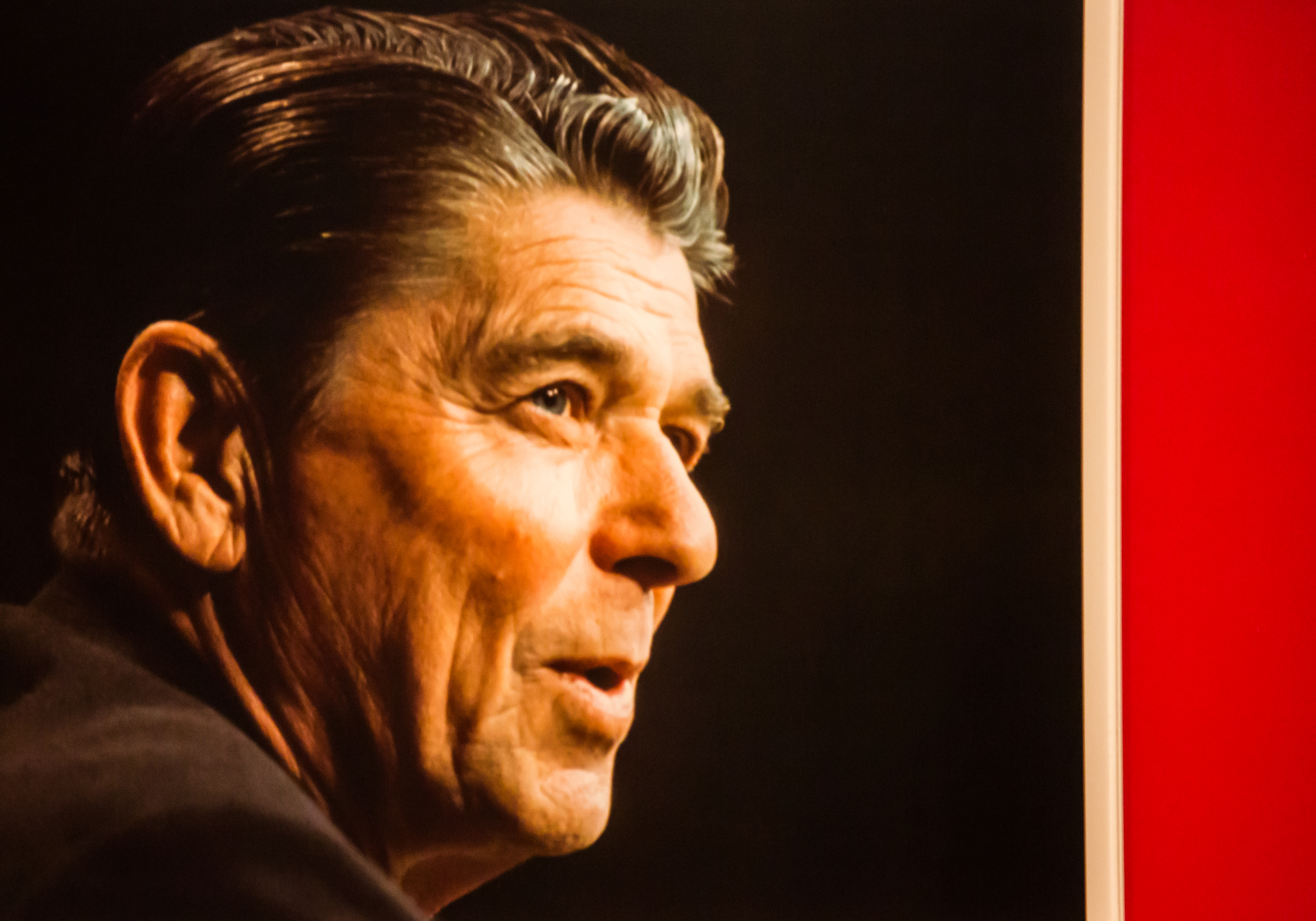

The trickle-down model was popularized by the Reagan administration’s vast capital gains and income tax cuts and its promotion of largely unfettered capitalism throughout the 1980s. The results of this so-called Reaganomics platform were mixed, as these laissez-faire policies overcame the existing recession but caused the national debt to skyrocket from under $1 trillion in 1981 to roughly $2.9 trillion by 1989. In 2001 and 2003, trickle-down theory was once again thrust to the forefront of economic policy making with the enactment of tax cuts under the Bush administration. The assured, across-the-board benefits of the tax cuts never panned out, yielding underwhelming employment growth, worsened poverty levels, and exacerbated income inequality in the lead-up to a recession that came to devastate the American middle and lower classes.

In spite of the detrimental implications of Bush-era tax cuts on everyday Americans, trickle-down ideology continues to shape American fiscal policy, as exemplified by President Trump’s Tax Cuts and Jobs Act of 2017. Championed by the GOP, the sweeping tax reforms slashed corporate tax rates from 35 percent to 21 percent. The President’s Council of Economic Advisers (CEA) claimed that the reform package would increase average US household income by at least $4,000 per year based on conservative estimates, and as much as $9,000 per year based on optimistic estimates. While the holistic economic impact of Trump’s tax reforms may require time to fully emerge, business investment and income growth are still not nearly on pace to achieve these approximations. Indeed, between 2017 and 2018, median household income grew by merely $553, falling far short of the projections the CEA cited in backing Trump’s tax overhaul.

The comprehensive analyses refuting trickle-down theory are numerous. A recent study found that tax cuts for lower-income groups do tend to facilitate encouraging employment growth, but that tax cuts for the upper 10 percent have a muted effect on job creation. This reflects the basic flaw in the philosophy of supply-side economics as a viable approach to advantaging the lower classes, as this view overestimates the extent to which businesses will expand and hire workers following tax cuts. In fact, instead of investing in corporate growth initiatives in the wake of Trump’s tax cuts, companies tended to direct their freed-up capital towards unprecedented levels of stock buybacks in order to help shareholders. This undercuts the very premise of trickle-down theory, confirming that tax reductions afforded straight to poorer individuals are much more effective than attempting to indirectly improve opportunities by reducing taxes for wealthy corporations and elites.

Even on the global stage, trickle-down theory has been conclusively debunked, as the International Monetary Fund (IMF) found “that increasing the income share of the poor and the middle class actually increases growth while a rising income share of the top 20 percent results in lower growth—that is, when the rich get richer, benefits do not trickle down.” Equally telling is that, since the start of the upwardly redistributive tax policies of the 1980s, world economic growth has slowed considerably. Whereas global GDP per capita grew by a yearly average of almost 2.8 percent during the 1960s and 1970s, growth from the 1980s to present has virtually halved, resting at just over 1.4 percent per annum. Clearly, the theorized economic growth brought about by pro-rich tax policies has not manifested itself.

And yet, under the unsubstantiated guise of trickle-down benefits for society as a whole, tax cuts for the rich have proven an abiding staple of US economic policy. This confuted theory owes much of its relevance to the continued fashionability of economist Arthur Laffer within Republican political circles. Laffer, who was awarded the Presidential Medal of Freedom earlier this year, developed the economic curve behind which trickle-down theory was conceived and budgetarily rationalized. The Laffer curve posits that the federal government would actually be best served to reduce high marginal rates as a means of enhancing revenues. By lowering rates, high earners—including wealthy corporations and investment enterprises—would have more money with which to participate in the economy, consequently contributing to accelerated growth for the country. This would purportedly widen the US tax base, expanding the nationwide volume of taxable assets and generating more federal revenue than if taxes on the rich were steepened. In short, under Laffer’s view, tax cuts for the wealthy more than pay for themselves.

While the Laffer curve may seem feasible on paper, the massive losses spurred by trickle-down economic policies paint a different picture, from Reaganomics debt accumulation to the Bush tax cuts—which, rather than increasing revenues as Laffer suggests, were the largest contributor to the national deficit and lowered government revenues by $1.8 trillion from 2002 to 2009. Nonetheless, Laffer’s popularity among Republicans has endured on the basis of unfulfilled promises regarding growth for the greater economy and net revenue boosts, despite proof that frequently iterated Republican tax cuts have only benefited wealthy, self-interested people and companies. From the neoliberal renaissance of the late 1970s up to the year 2010, the phrase “Laffer curve” was used 425 times in debate on the floors of Congress, demonstrating its status as a mainstay of economic policy discourse. More recently, Laffer has remained a highly sought-after figure within the GOP establishment, as during the 2016 presidential primary cycle, he was “more in demand than ever before, with Republican candidates embracing tax-cut-for-the-rich policies even as they bemoan[ed] economic inequality.”

Republicans have been consistently favorable in their views of the otherwise disparaged Laffer curve and the trickle-down theory it professes to justify. Evidently, the unrelenting Republican advocacy of this misguided tax policy is due in no small part to the fact that it inherently helps more affluent individuals, who comprise a disproportionate amount of the Republican voter base. Moreover, the political allegiances embedded in the perpetuation of fiscal conservatism extend to the efforts of lobbyists and Political Action Committees (PACs). This is epitomized by the fervently anti-tax Club for Growth. On top of the $6.7 million it gave to outside spending organizations during the 2018 election cycle, the group’s affiliated super PAC contributed $3.6 million to federal candidates, all of which went towards Republican candidates for the House and Senate. Unsurprisingly, the Club for Growth is heavily funded by the ultra-rich, with eight donors—including billionaire PayPal founder Peter Thiel—contributing at least $350,000 each to the PAC last cycle. Associations like the Club for Growth, then, play pivotal roles in compelling the GOP’s commitment to tax cuts that ultimately bolster the rich above all else.

The elitist economic mindset that sustains trickle-down theory is dangerous for the future of an America that strives for egalitarianism and authentic—not merely conjectural—support systems for the lower and middle classes. As long as the sophistry of trickle-down ideologues persists, so too will the corrosive codification of self-serving tax policies for the wealthy.

Photo: Image via Thomas Hawk (Flickr)

Doesn’t work now; didn’t work then. Oh for the days of Carter and Nixon (economically speaking).

Trickledown economics is a misnomer. There is no such theory and no one has ever claimed to employ it. The name was invented as a buzzword for democrats to deride Reagan’s supply side economics. Also Reagan’s desire to defeat the Soviet Union was what increased the national debt and was both successful and worth every penny. I’m guessing by the liberal use, pun intended, of equitable and sustainable obviously it’s a lesson you failed to learn, the fact that Marxism doesn’t work.