For the past two years, the nature of work in the United States changed drastically. From March 2021 to July 2022, at least 3.7 million workers quit their jobs every month, the highest level on record since the Bureau of Labor Statistics first started collecting data in 2000. As the coronavirus pandemic led more people to reassess their work priorities, many industries experienced severe labor shortages. Given the tight labor market conditions, workers across the nation have seized the moment to negotiate for better wages and conditions. Amazon and Starbucks employees, for example, formed historic unions, and workers are striking in record numbers. These developments led some observers to conclude that workers have finally reasserted their power. This is a “new era for worker power,” noted Alí Bustamante, an economist at the Roosevelt Institute.

Yet, this narrative obscures a more concerning reality. Despite all these conversations about worker power, the bargaining position of workers has not fundamentally changed. One can look at the differential impact of the recent wave of inflation to see the continued power imbalance between companies and their workers. Even though nominal wages have increased steadily, they have not kept pace with the rate of inflation. In December 2021, inflation-adjusted wages were 3.3 percent below predicted real wages based on pre-pandemic trends, and they have continued to decrease into 2022. In the meantime, corporations were able to protect their profit margins by hiking prices and controlling labor costs. Pre-tax corporate profits increased by 25 percent to $2.8 trillion in 2021, far surpassing the inflation rate in the same period.

As Director of Research at the Economic Policy Institute Josh Bivens points out, this distributional outcome is the result of highly unbalanced bargaining power between corporations and workers. Even if the current labor shortage gave workers some negotiating leverage, corporations still have enough power to resist upward wage pressures and protect their margins. The external shocks rippling through the economy over the past two years have simply not been enough to reverse decades of policies that have systematically eroded the power of labor.

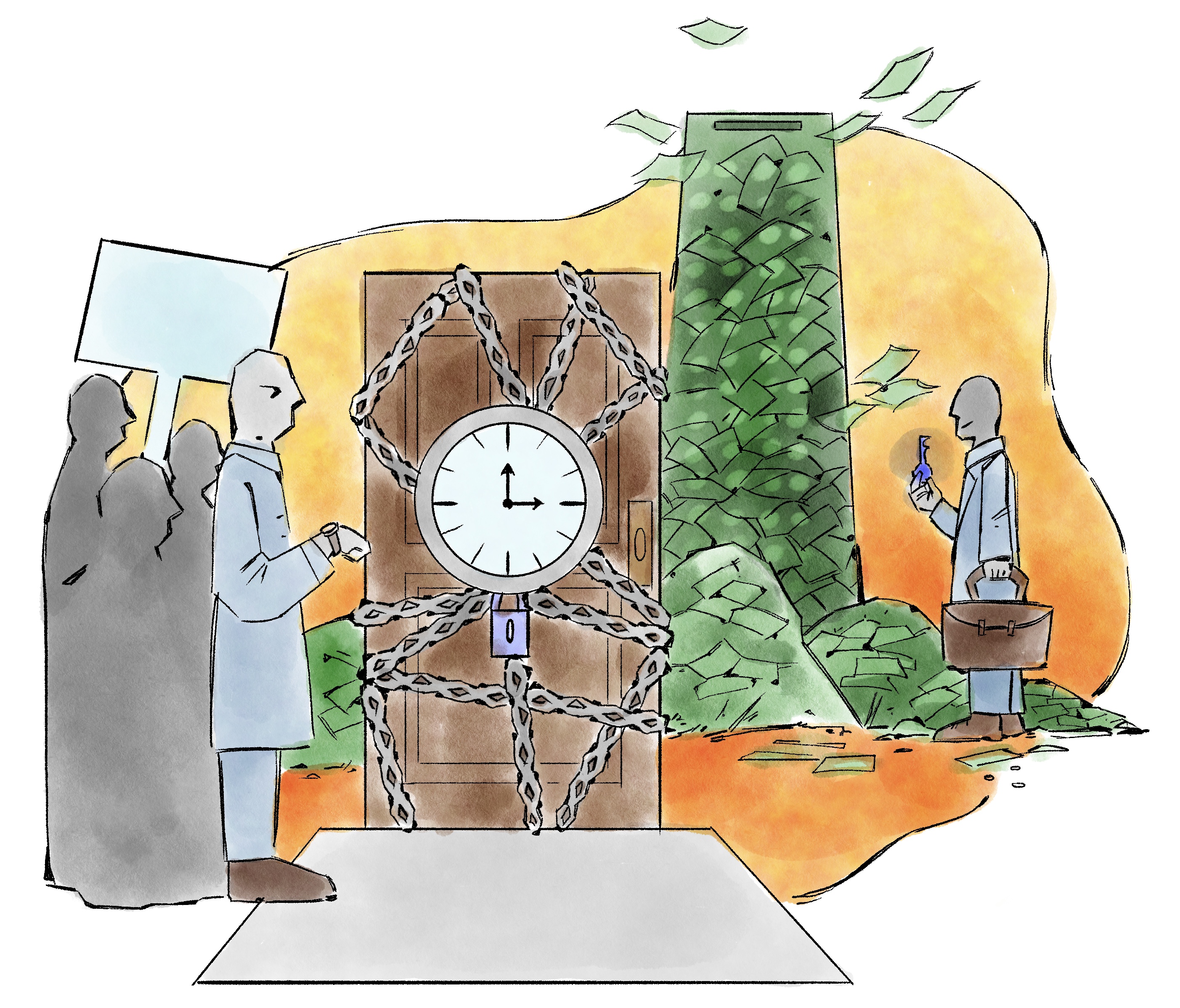

One area where this is apparent is the labor laws. In theory, corporations could dismiss union workers at will and face no legal repercussions for refusing to negotiate with unions. This means that only a few workers can complete the tenuous process of unionization and even fewer are able to actually win better contracts. Admittedly, workers in strategic industries could force concessions from management via the prospect of a large-scale strike disrupting the entire supply chain. For example, in September 2022, to avoid mass strikes, the Biden administration brokered a new five-year contract for railroad workers with a 24 percent pay increase. However, in industries with low unionization rates and high turnover rates, workers have little power to force employers to the negotiating table given the low costs associated with firing workers. Therefore, even in an economy of high job openings and low unemployment, indicators such as inflation-adjusted wages, labor share of national income, and the pay-productivity ratio have continued their downward trend. Contrary to popular narratives about a labor revival, workers have struggled to gain real power according to most of the concrete measures.

More importantly, macroeconomic policies set to be implemented in the coming years will likely further erode workers’ bargaining position. As inflation remains high, many policymakers expressed concerns over the possibility of a wage-price spiral. This is the theory that inflation could spiral upwards if wages and prices keep pushing each other up. Even though wages have lagged far behind inflation and there is almost no correlation between wage inflation and price inflation on an industry level, the Federal Reserve remains convinced of the need to exert strong pressure on the labor market to bring down inflation. In a May 2022 press conference, Jerome Powell, the Federal Reserve Chairman, stated that his plan is to “get wages down and then get inflation down” and vowed to continue with sharp interest rate hikes even if they could “bring some pain” to the economy. The bank has already hiked interest rates three times this year and has shown no intention of slowing down. As aggregate demand contracts due to interest rate hikes, the likely result is that many firms will reduce hiring and initiate layoffs, leading to higher unemployment. If workers cannot make substantive wage gains even in a tight labor market, it is difficult to see how they could protect their wages in a time of economic recession. In that case, the brunt of disinflation could unravel any progress made by organized labor over the past two years.

All of this points to a fundamental problem with the narrative of worker power. Even though the coronavirus pandemic led to a reassessment of work and a resurgence in collective bargaining practices, these changes are still taking place in an environment that antagonizes the empowerment of workers. For decades now, the government has pursued policies, such as austerity measures and anti-union regulations, that tend to counteract any bottom-up momentum for wage gains. In order for a true labor revival to occur, there must be a change to this tendency of prioritizing price stability and economic growth over a more equitable distribution of productivity gains. This means more cautious interest rate hikes, alternative disinflation measures like windfall profit taxes and supply chain investments, and a systematic effort to reform labor laws and curb excess corporate power. The era of worker power will only come if there is a paradigm shift in how policymakers frame their economic priorities. Otherwise, it will remain a facade.